Businesses in this industry catch inshore, estuarine, offshore and freshwater fish, finfish, molluscs, crustaceans, prawns, rock lobsters, oysters and pearls. This is underpinned by current and emerging practices utilising technology and traceability systems to provide consumers with information on seafood provenance and production methods, inclusive of maintaining aquatic animal health, carbon emission mitigation, and regulatory compliance.

Key updates

Projected sector growth and workforce planning

Jobs and Skills Australia data projected the industry workforce to grow 8.2% by 2028, and 16.4% by 2033. Currently, there is no industry-led national approach to validating workforce data and projecting future growth. Data and evidence have been collected in select regions, such as that found in ‘Future-proofing the NA aquaculture industry need for skilled staff to 2050’, which may be used to support place-based workforce planning activities; however, this data may not represent national trends. Stakeholder feedback and a current Fisheries Research and Development Corporation (FRDC)-commissioned project indicates the need for developing and maintaining a reliable national workforce data collection which can be used to support seafood industry workforce planning.

Empowering the First Nations fishing sector

In line with the National Fisheries Plan 2022-30, work is being progressed by the Fisheries Research and Development Corporation Indigenous Reference Group and the Australian Fisheries Management Forum Indigenous Working Group to support understanding of First Nations needs and priorities for participation in the sector.

Career pathways promotion

In response to increased competition in the labour market, industry peak bodies have released industry focused career pathway websites, including the Seafood Careers Australia and Seafood Jobs Tasmania websites, to promote employment opportunities in the industry.

Opportunities

Rising seafood consumption driving industry revenue

Demand for healthy proteins like fish

and seafood has grown, which is pushing up industry profitability recently, particularly with elevated prices.

Increased investment

As part of the Government’s $72.7 million investment in expanding Australian export markets, Austrade and the seafood industry have developed a plan to promote and diversify into markets such as Europe and the Middle East, which could see more work opportunities within the sector.

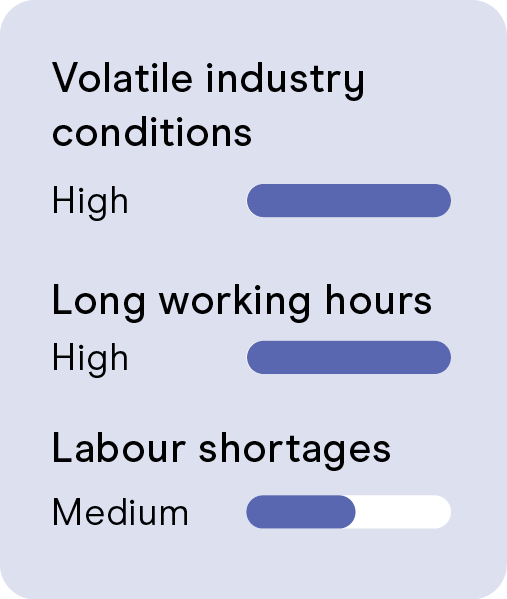

Challenges

Sensitive to regulations

The industry is prone to impact by State and Territory Licensing and Permit Regulations. For example, new limits for commercial barramundi fishing were recently set from important fishing areas in the Northern Territory that may result in job losses.

High & increasing barriers to entry

Industry consolidation in recent years has led to a moderately concentrated market, with major players accounting for >40% of industry revenue.

Data monitoring priorities

9,934

workers

(2021 Census)

4.7%

First Nations

(2021 Census)

900

2028 Projection

(JSA Projections)

22%

Female

(2021 Census)

Workforce Plan 2024

The Workforce Plan describes workforce challenges and skill opportunities identified by stakeholders across the industries we work with and outlines strategies to address them.

The 2024 Workforce Plan outlines four key Workforce Planning Priorities to guide the strategies and planning of our JSC work, retaining the strategic intent of the Initial Workforce Plan, with modifications to align with the Australia Government’s White Paper on Jobs and Opportunities.