The product manufacturing industry is a vital part of the timber value chain, turning harvested trees into materials that can be used to construct buildings, furniture, flooring, timber products and other items. High levels of technical skills are required for operating the latest technologies in drying and cutting, including optimisation equipment, allowing industry to continue to supply the high-quality timber that is used to produce some of our most essential structures and products.

Key updates

Cyclical demand within industry

In line with the industry’s sensitivity to housing construction activity, the number of workers in the Labour Force Survey for most key occupations have fluctuated in recent years. Overall demand as observed through cumulative hours worked showed that Timber and Wood Process Workers have been in a declining trend.

VET enrolments still in recovery

Data from NCVER showed that whilst VET enrolments in relevant FWP Qualifications have increased from 298 in 2020 to 522 to 2022, it has yet to recover to pre-pandemic levels.

Opportunities

Technology adoption

Manufacturers, particularly softwood sawmills, are improving operational efficiencies and product customisation by investing in technologically efficient machinery.

Environmental advantage

There is emerging consumer awareness of the key role of forestry in carbon sequestration and storage, which will significantly contribute to meeting Australia’s 2050 net zero emissions target.

Legislative changes

Recent Government assistance relating to the housing construction sector may positively influence demand.

Challenges

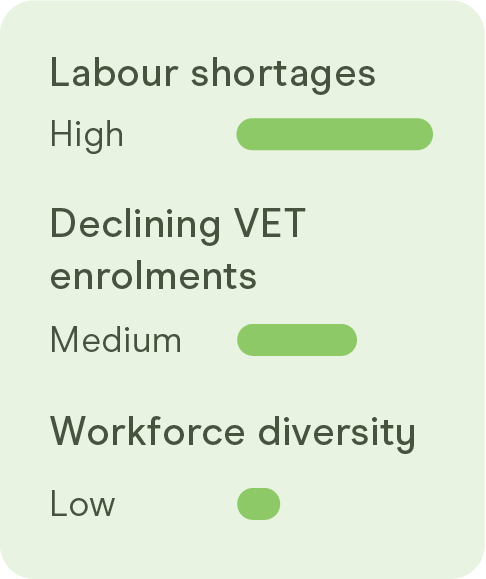

Attracting new skilled workers

Despite a 1% rise from 2016, women accounted for only 19% of workers in the 2021 Census. There are challenges in attracting women and other priority cohorts to the workforce, and addressing thin training markets in regional areas, to help alleviate skill shortages, which may be exacerbated by a large proportion of the workforce approaching retirement age.

Volatile conditions

Activity within the industry is highly dependent on both upstream suppliers and downstream buyers. Competition from substitute products (e.g. steel and plastic) contributes to revenue volatility, which affects workforce attraction and retention.

Supply and demand

Housing shortages and population growth are raising demand for wood-based construction materials, such as engineered wood products and cross-laminated timber, in urban areas. However, the industry’s capacity to meet this demand depends on the availability of forest resources, including plantations, and the policies and practices that regulate forests’ management, establishment, and utilisation.

Data monitoring priorities

26,738

workers

(2021 Census)

2.4%

First Nations

(2021 Census)

5,551

2028 Projection

(JSA Projections)

19%

Female

(2021 Census)

Workforce Plan 2024

The Workforce Plan describes workforce challenges and skill opportunities identified by stakeholders across the industries we work with and outlines strategies to address them.

The 2024 Workforce Plan outlines four key Workforce Planning Priorities to guide the strategies and planning of our JSC work, retaining the strategic intent of the Initial Workforce Plan, with modifications to align with the Australia Government’s White Paper on Jobs and Opportunities.